Klarna's New Price Comparison Tool: How Does It Compare to Other Online Comparisons?

2023-04-19

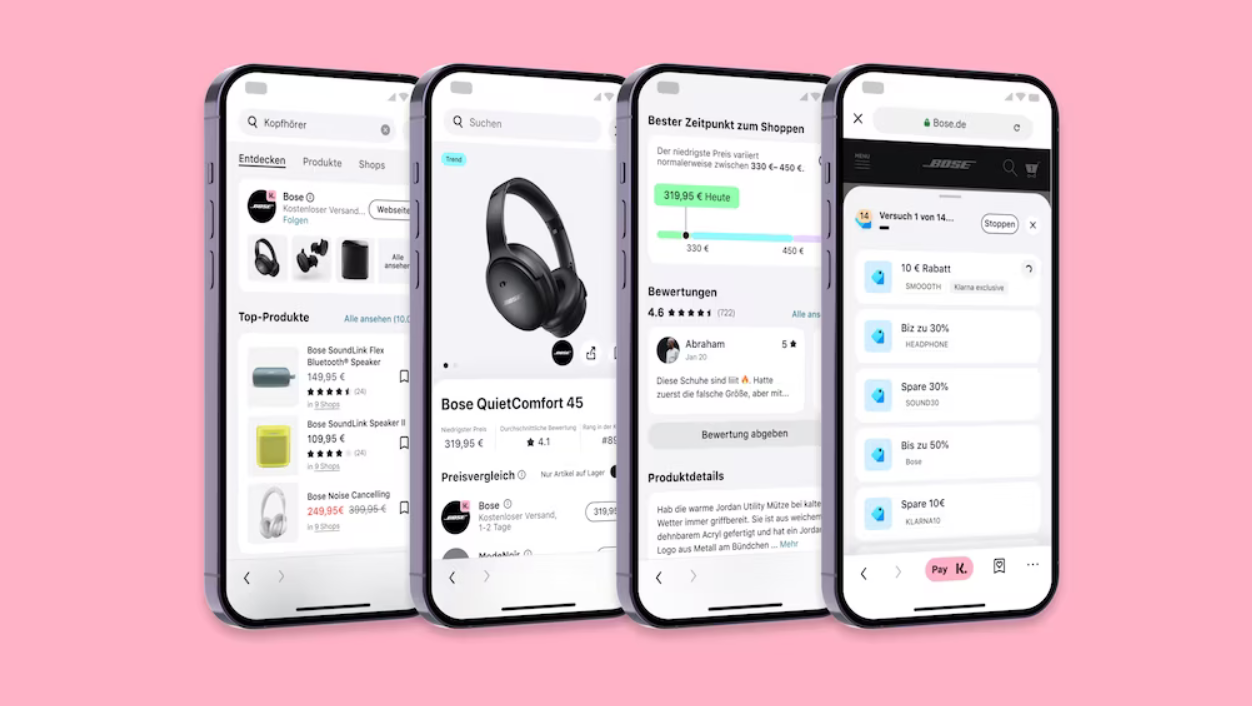

Klarna has been pursuing the goal of offering everything related to shopping in one place for years, and their latest step towards this is the launch of their own price comparison tool. This “comprehensive and independent price comparison tool” is intended to provide a “trusted alternative to Google or Amazon” within the Klarna app. This approach suggests that Klarna is looking to differentiate itself from established price comparison sites. In this blog post, we will look at what is known about the Klarna price comparison tool and how it differs from other online price comparison sites.

Like idealo.de, Check24.de, and Billiger.de, Klarna also wants to enable consumers to find the best price for products quickly with its new tool. When searching for a product in the app or on the website, users are presented with a list of shops that offer it. Users can see if the listed online shop has the product in stock, how much it costs, and how the price has developed in recent weeks. According to the company’s press release, “consumers can filter their search by criteria such as color, size, features, customer reviews, availability in stores, and shipping options.” The technology is based on Pricerunner, which Klarna acquired in 2021.

Klarna launched its price comparison tool in the US, the UK, Sweden, and Denmark in 2022. It has been available in Germany since April 13, 2023. This move strengthens the company’s affiliate marketing business further. Klarna already generates 600 million leads annually for its retail partners. A lead is a potential customer who visits the online shop of retailers via the price comparison tool and then, ideally, makes a purchase. Klarna offers not only opportunities to spend money but also allows customers to park their savings in a fixed-term deposit account, currently offering 2.08% for six months and 3.13% for twelve months.

All well-known price comparison platforms work with affiliate programs, meaning the platform sends customers to shops and earns money in return. This can be done through leads or a commission, where the platform receives a fixed percentage of the money customers spend in the online shop. Typically, online shops or providers that do not pay do not appear in the results of price comparisons. However, Klarna claims to be different. It lists “products from non-paying third-party sellers,” as reported by Finance Forward. These appear grayed out and without a link to the respective online shop. Currently, according to the company, the share of these third-party sellers is around 15 to 20 percent.

Klarna also does not prioritize its products in search results compared to other price comparisons. “Products are listed impartially at Klarna,” says Klarna Germany CEO Nicole Defren in an interview with Finance Forward.